Wake County Property Tax Rate 2024 Neet Application – While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation Wake County’s tax administrator. “They feel that property .

Wake County Property Tax Rate 2024 Neet Application

Source : issuu.com

News | City of Rolling Fields

Source : www.rollingfieldsky.com

EURER #8 Growth Over the Next Decade: Part 2 of Living Up to

Source : issuu.com

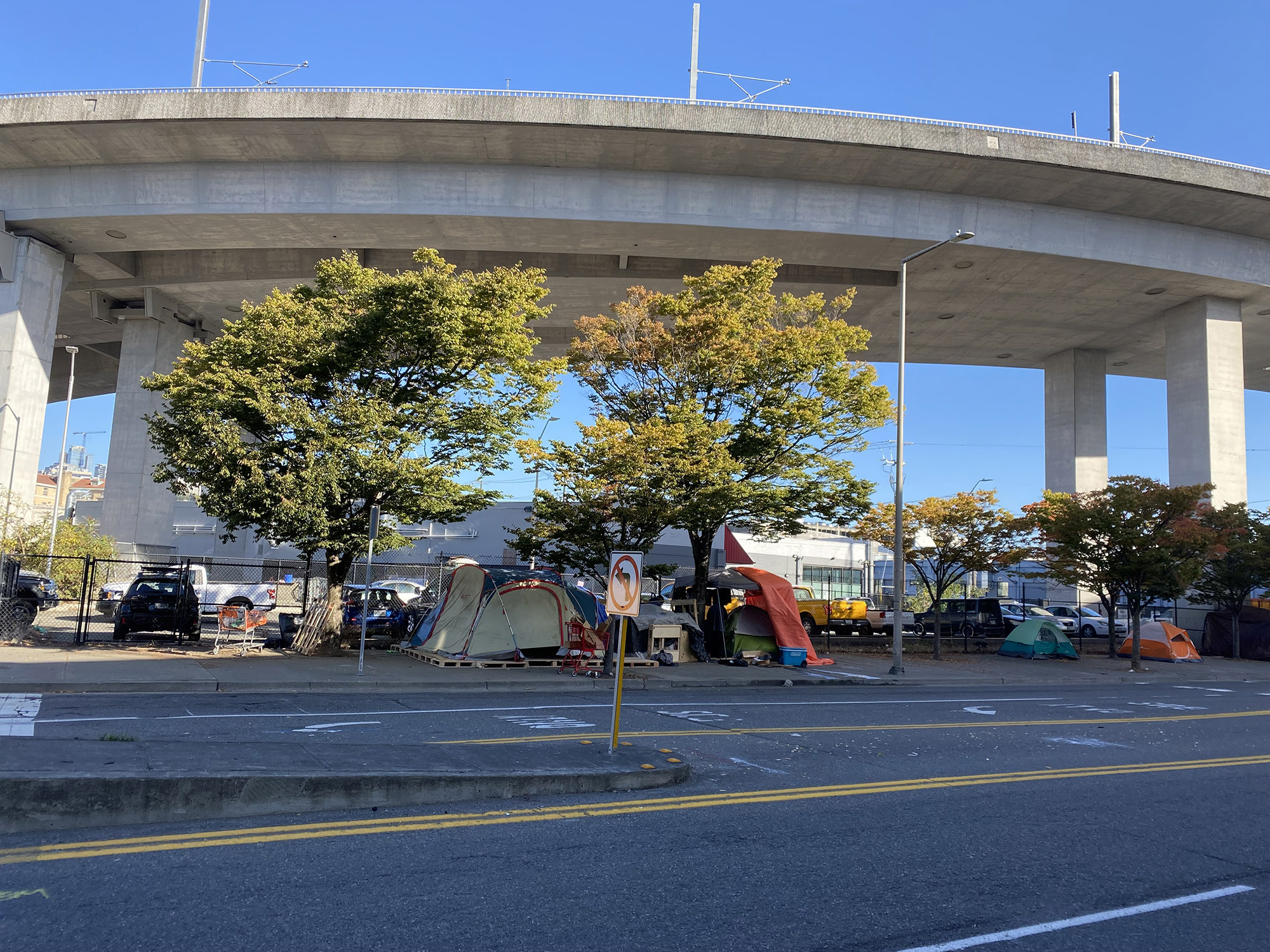

Homelessness in US cities and downtowns | Brookings

Source : www.brookings.edu

Global Minimum Tax: An easy fix? KPMG Global

Source : kpmg.com

Delhi Weather Live News Updates: Winter vacation in Delhi schools

Source : economictimes.indiatimes.com

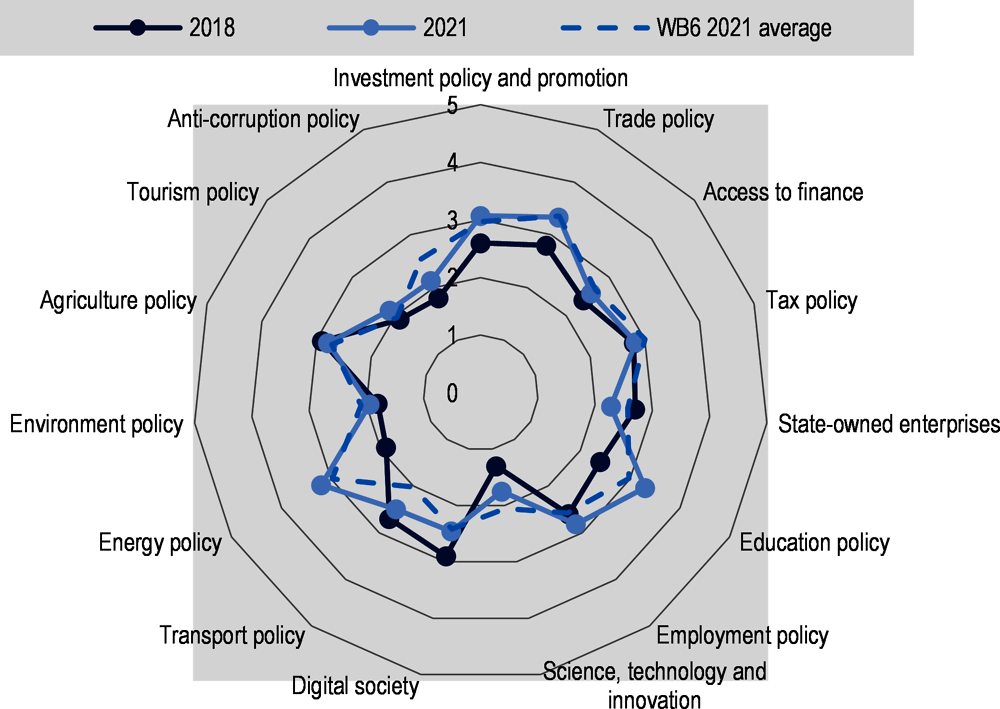

20. Albania profile | Competitiveness in South East Europe 2021

Source : www.oecd-ilibrary.org

02272011 SLS A01 by Salisbury Post Issuu

Source : issuu.com

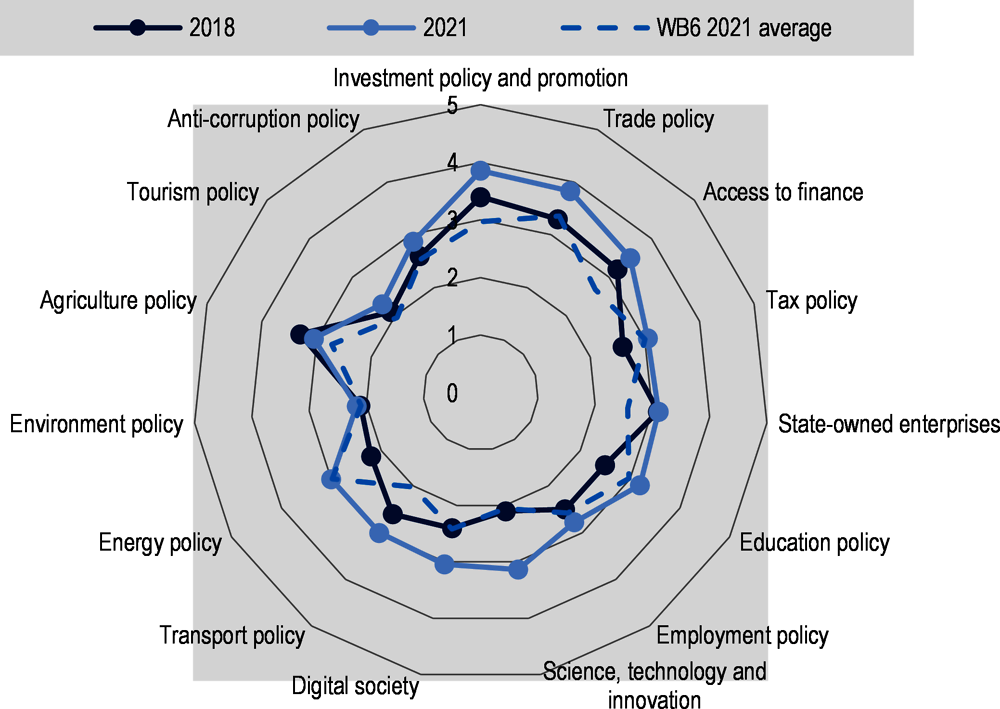

25. Serbia profile | Competitiveness in South East Europe 2021 : A

Source : www.oecd-ilibrary.org

02162011 SLS A01 by Salisbury Post Issuu

Source : issuu.com

Wake County Property Tax Rate 2024 Neet Application EURER #8 Growth Over the Next Decade: Part 2 of Living Up to : Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 feel that property taxes may go up at the same rate that their . RALEIGH, N.C. (WTVD) — Homeowners in Wake County may soon have to pay more in property taxes. County commissioners said they expect property values to increase when 2024 revaluations are sent out. .